By Jason Clemens

and Joel Emes

The Fraser Institute

For working Canadians, contributions to the Canada Pension Plan (CPP) are a regular bill on their paycheques. Those contributions, however, secure a future benefit when they retire. The value of that benefit varies greatly depending on when one was born.

The Fraser Institute recently released a study that calculated CPP rates of return (nominal and real) received by Canadian retirees. One of the main reasons for the study was to clarify the difference between returns earned by the investment arm of the CPP (Canada Pension Plan Investment Board) and the actual returns received by retirees in the form of CPP retirement benefits.

Clemens

In response to the study, however, one of the near-constant questions from the media related to generational inequity. While not a focus of the study, the results clearly show a marked generational gap in the benefits received from the CPP depending on when a person was born.

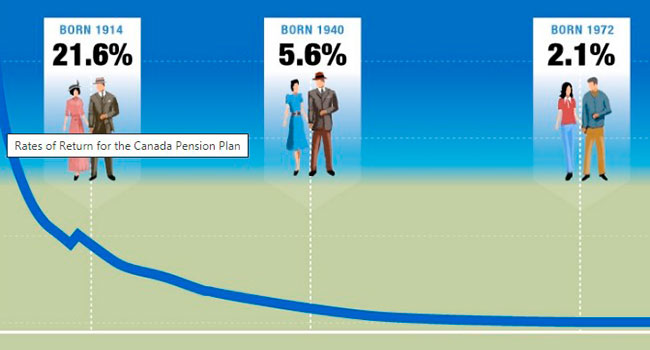

For example, Canadians retiring (at age 65) between 1970 and 1979, which is one of the earliest cohorts to receive CPP benefits, enjoyed an average rate of return of 27.5 per cent. The rates of return within this time period ranged from 39.1 per cent for those born in 1905 to 21.6 per cent for those born in 1914. Any investor would leap at these returns.

However, there is a pronounced decline in the returns in the next decade. The average rate of return for those retiring between 1980 and 1989 was 15.9 per cent, almost half the rate of the previous period.

The rates of return continue to fall as the time period is extended: 2020-2029 (2.8 per cent), 2030-2039 (2.2 per cent), and 2040 and thereafter (2.1 per cent).

There are two principal reasons for the marked declines in the rates of return. First, retirees in the early periods paid into the CPP over a shorter time period compared to younger Canadians. Second, the contribution rate (i.e. tax) has increased from 3.6 per cent when the CPP was launched in 1966 to its current level of 9.9 per cent.

The generational inequity exists in the fact that the longer contribution period and higher contribution rates for younger workers pay for basically the same benefit as the shorter contribution period and lower contribution rate of earlier generations. In other words, older Canadians and particularly those that retired in the late 1960s and 1970s paid into the plan for a much shorter period of time at much lower contribution rates to get basically the same benefit as workers who contributed over much longer periods of time and at higher contribution rates.

The actual benefits provided by the CPP are critical to understand as the country debates whether or not to expand the existing plan, which as demonstrated above hasn’t and won’t provide decent rates of return for younger workers.

Jason Clemens and Joel Emes are economists with the Fraser Institute.

Jason and Joel are Troy Media Thought Leaders. Why aren’t you?

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.