The importance of a compelling and quantitative value proposition

There is massive potential profit to be made in exploiting truly innovative, disruptive technology. But changing the world necessarily entails risks. Perhaps the most fundamental of these is getting the market to adopt the new innovation, as most people are generally reluctant to change what they are doing in favour of an alternate solution.

There is massive potential profit to be made in exploiting truly innovative, disruptive technology. But changing the world necessarily entails risks. Perhaps the most fundamental of these is getting the market to adopt the new innovation, as most people are generally reluctant to change what they are doing in favour of an alternate solution.

The first way entrepreneurs should mitigate risk, therefore, is to create business models that compel the market in their favour by delivering economically attractive solutions. Toward this end, startups should be founded on immediate, compelling, and quantitative value propositions (or “iCQVPs”).

Almost 25 years ago, my team and I created an automated microscope that systematically searches through anything you could put on a slide (such as blood), looking for the proverbial needle in a haystack. Our task was to automate and dramatically improve pathologists’ ability to find a few cancer cells among a matrix of millions of normal cells.

|

|||||

|

In short, we were able to reduce the diagnostic process from hours to minutes with nearly 100 per cent identification – a fundamental step change in cellular diagnostics. Since earlier and more reliable detection leads to earlier treatment, this technology promised better patient outcomes. As an article in Science points out, “57 per cent of people with lung cancer survive their disease for five years or more when diagnosed at stage I compared with only three per cent of those diagnosed at stage IV.” Early detection also generates tremendous savings for the health-care system.

When introducing this disruptive solution into the market, we planned to sell instruments that would materially reduce the life-cycle cost of patient care. We quantified this benefit to insurance companies and demonstrated that by buying a machine for a few hundred thousand dollars, they could save many millions of dollars in a few short years.

We quickly learned, however, that insurance companies would not pay for such a system upfront. They didn’t want to outlay capital when the relevant patients could be in someone else’s insurance pool by the time the savings would be realized.

That roadblock led us to rethink our business model. We needed to provide an immediate benefit to the payor – in this case, the insurance companies – without the risk.

As such, we redesigned our value proposition by providing the instrument to the payors for free. In return, we asked for a revenue share for any new incremental dollars the instrument could produce. Every time the instrument ran a reimbursable test, we would receive one-third of the revenue, and the client would receive two-thirds.

With this new value proposition, the benefits to the market were immediate: insurance companies received money for every test run on the instrument from the start. This was compelling because insurance companies could adopt this new approach with nearly zero risk since it required no upfront investment. Finally, it was quantitative – if reimbursement for a given test was $3,000, the client received $2,000. Previously, insurance companies had outsourced this work to reference laboratories, so our machine constituted a new source of revenue.

This fundamental change in the business model reduced risk and generated profit for our clients, leading to their rapid adoption of the invention. It also actually created more value for us than our original plan of selling the instruments would have.

I have designed business models with the iCQVP methodology ever since learning that lesson early in my career. Many entrepreneurs balk at the idea of taking on truly disruptive enterprises.

Still, in my experience, it’s just as hard (or as easy) to make a billion dollars as it is to make a million. Part of the secret is creating business plans around iCQVPs.

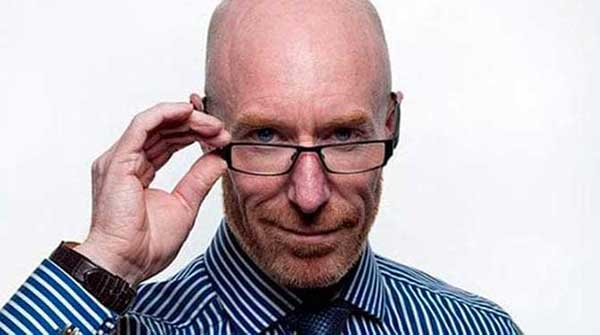

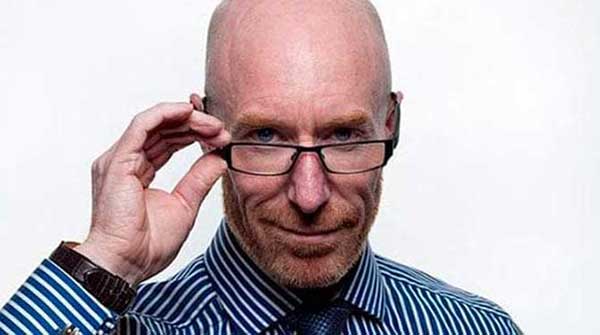

Bill Haskell, CEO of Innventure, has spent over 30 years building high-growth businesses. He has directed over a dozen private and public companies. Innventure specializes in creating, funding, operating, and scaling companies in strategic collaboration with Multinational Corporations (MNCs). Their business model allows Innventure to recognize and cultivate assets with the potential to reach a valuation in excess of $1B within five years.

For interview requests, click here.

The opinions expressed by our columnists and contributors are theirs alone and do not inherently or expressly reflect the views of our publication.

© Troy Media

Troy Media is an editorial content provider to media outlets and its own hosted community news outlets across Canada.